Navigating the complexities of immigration regulations can be daunting, especially for employers. Understanding the purpose and proper completion of an I-9 document is crucial for ensuring compliance and avoiding potential penalties. This comprehensive guide will delve into the intricacies of I-9 documents, providing a clear understanding of their significance, the process involved, and the consequences of non-compliance.

An I-9 document, also known as an Employment Eligibility Verification Form, serves as a critical tool for employers to verify the identity and employment authorization of their employees. It is a legal requirement under the Immigration Reform and Control Act (IRCA) and plays a vital role in preventing unauthorized employment and promoting a fair and equitable workforce.

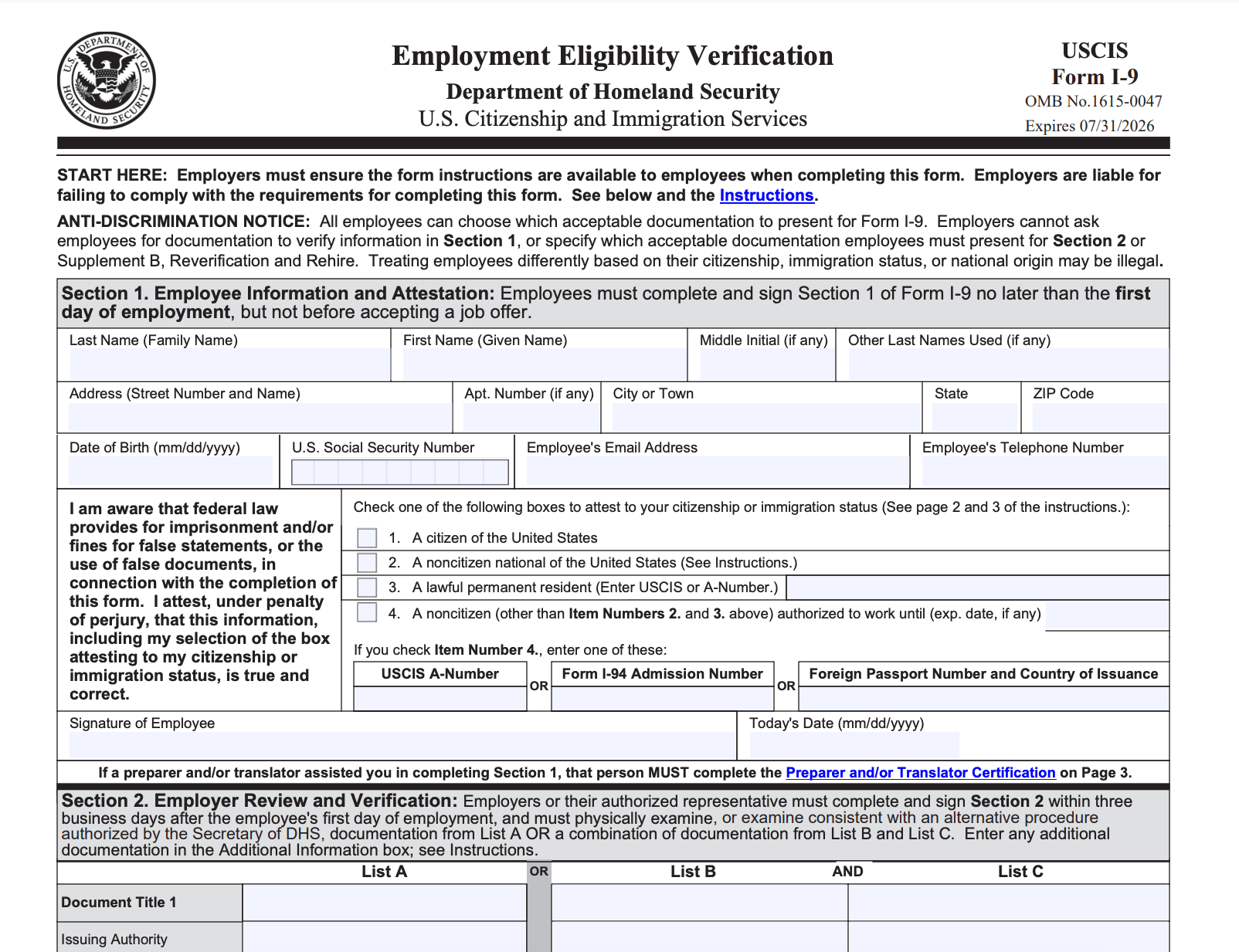

What is an I-9 Document?

An I-9 Document is an Employment Eligibility Verification Form used in the United States to verify the identity and work eligibility of individuals hired for employment in the country. The form is mandatory for all employers and must be completed and retained for all employees, regardless of their citizenship or immigration status.

The primary purpose of the I-9 Document is to prevent the hiring of unauthorized workers and to ensure that employers are complying with federal immigration laws. It also helps to protect employers from potential penalties for knowingly hiring undocumented workers.

Individuals Required to Complete the Form

All individuals hired to work in the United States, regardless of their citizenship or immigration status, are required to complete an I-9 Document. This includes citizens, permanent residents, temporary workers, and undocumented workers.

Specific Information Collected on the Form

The I-9 Document collects specific information about the employee, including their:

- Full name

- Date of birth

- Social Security number

- Address

- Citizenship or immigration status

- Documents presented to verify identity and work eligibility

The I-9 Document also includes a section for the employer to complete, which includes the date of hire and the employee’s job title.

Completing an I-9 Document

Filling out an I-9 form is a legal requirement for all employees in the United States. It’s a straightforward process, but there are a few things you need to know to do it right. Here’s a step-by-step guide to help you complete your I-9 document.

Employer’s Responsibilities

As an employer, you’re responsible for completing Section 1 of the I-9 form within three business days of hiring an employee. You’ll need to provide the employee with a blank form and ask them to complete it. Once the employee has completed their part, you’ll need to verify their identity and work authorization. You can do this by examining original documents, such as a driver’s license or passport, and completing Section 2 of the form.

Employee’s Obligations

As an employee, you’re responsible for completing Section 1 of the I-9 form on your first day of work. You’ll need to provide your employer with your name, address, and date of birth. You’ll also need to attest to your identity and work authorization. You can do this by providing your employer with original documents, such as a driver’s license or passport.

Verifying Documents

Verifying documents is a crucial step in the Form I-9 process, ensuring that the employee’s identity and employment authorization are genuine. Employers must adhere to strict requirements when verifying these documents to comply with immigration laws.

To verify an employee’s identity, employers can use one of the following documents:

- U.S. passport

- U.S. passport card

- Permanent resident card (Green Card)

- Foreign passport with a valid U.S. visa

- Employment Authorization Document (EAD)

- Certificate of U.S. Citizenship (Form N-560 or N-561)

- Certificate of Naturalization (Form N-550 or N-570)

For employment authorization, employers can verify using one of the following documents:

- Social Security card

- Permanent resident card (Green Card)

- Employment Authorization Document (EAD)

- Foreign passport with a valid U.S. visa

When reviewing supporting documents, employers should pay attention to the following:

- The document is original and not a copy.

- The document is not expired.

- The employee’s name and other information match the information on the Form I-9.

- The employee’s photograph (if applicable) matches the employee’s appearance.

Employers must retain supporting documents for three years after the date of hire or one year after the date of termination, whichever is later.

Retaining and Storing I-9 Documents

.png?w=700)

Innit, employers have a bluddy responsibility to keep I-9 documents safe and sound. They’ve gotta hold onto ’em for at least three years after the employee leaves or one year after their employment is terminated, whichever’s longer. And that’s not all, they’ve also gotta make sure the documents are stored securely, like in a locked cabinet or a password-protected computer system. That way, no one can nick ’em and use ’em for dodgy purposes.

Secure Storage Practices

When it comes to storing I-9 documents, employers need to be clued up on security. Here’s the lowdown:

- Lock it up: Keep I-9 documents under lock and key in a secure cabinet or safe.

- Password protect: If storing documents electronically, make sure they’re password-protected and only accessible to authorized personnel.

- Restrict access: Limit who has access to I-9 documents to only those who need to see them for work-related reasons.

- Train staff: Make sure your team knows the importance of protecting I-9 documents and how to handle them properly.

- Regularly review: Conduct regular audits to ensure that I-9 documents are being stored securely and in compliance with the law.

Common Mistakes to Avoid

Mistakes made when completing I-9 documents can lead to non-compliance with regulations and potential penalties. Avoid these common errors to ensure accuracy and compliance:

- Incorrect or incomplete personal information: Ensure that all personal information, including name, address, date of birth, and Social Security number, is accurate and complete.

- Missing or incorrect employer information: Verify that the employer’s name, address, and Federal Employer Identification Number (FEIN) are correct.

- Invalid or incomplete document verification: Ensure that the documents used for verification are valid, unexpired, and contain all necessary information. Review the list of acceptable documents carefully.

- Failure to retain and store I-9 documents securely: Maintain I-9 documents in a secure location for the required retention period. Establish a system for proper storage and retrieval.

- Neglecting to update I-9 documents: Update I-9 documents within three business days of any changes in an employee’s work authorization or identity. This includes changes in name, address, or employment eligibility.

Penalties for Non-Compliance

Failing to comply with I-9 regulations can have serious consequences. Employers may face hefty fines and other penalties for violations.

Fines and Penalties

The U.S. Department of Homeland Security (DHS) can impose fines ranging from $230 to $2,323 per I-9 form violation. Additionally, employers may be liable for back wages and benefits, as well as legal fees and other costs associated with defending against a government investigation or lawsuit.

FAQ Corner

Who is required to complete an I-9 document?

All employees, regardless of their citizenship or immigration status, must complete an I-9 document within three business days of their first day of employment.

What specific information is collected on the I-9 form?

The I-9 form collects personal information such as the employee’s name, address, date of birth, and Social Security number. It also includes sections for verifying the employee’s identity and employment authorization, requiring the employee to provide original or copies of acceptable documents.

What are the potential consequences of non-compliance with I-9 regulations?

Failure to comply with I-9 regulations can result in significant fines and penalties for employers. These penalties can range from hundreds to thousands of dollars per violation and may also include criminal charges in severe cases.