In today’s fast-paced world, managing finances effectively has become crucial. Among the many financial responsibilities, keeping track of monthly bills can be a daunting task. Introducing the Monthly Bill Free Printable Bill Payment Checklist, an indispensable tool designed to simplify and streamline your bill payment process.

This comprehensive guide will provide you with a clear understanding of the benefits and importance of using a printable bill payment checklist. We’ll explore the essential elements of a well-structured checklist, including due dates, payment amounts, and account numbers. Additionally, we’ll delve into customization options to tailor the checklist to your specific needs and preferences.

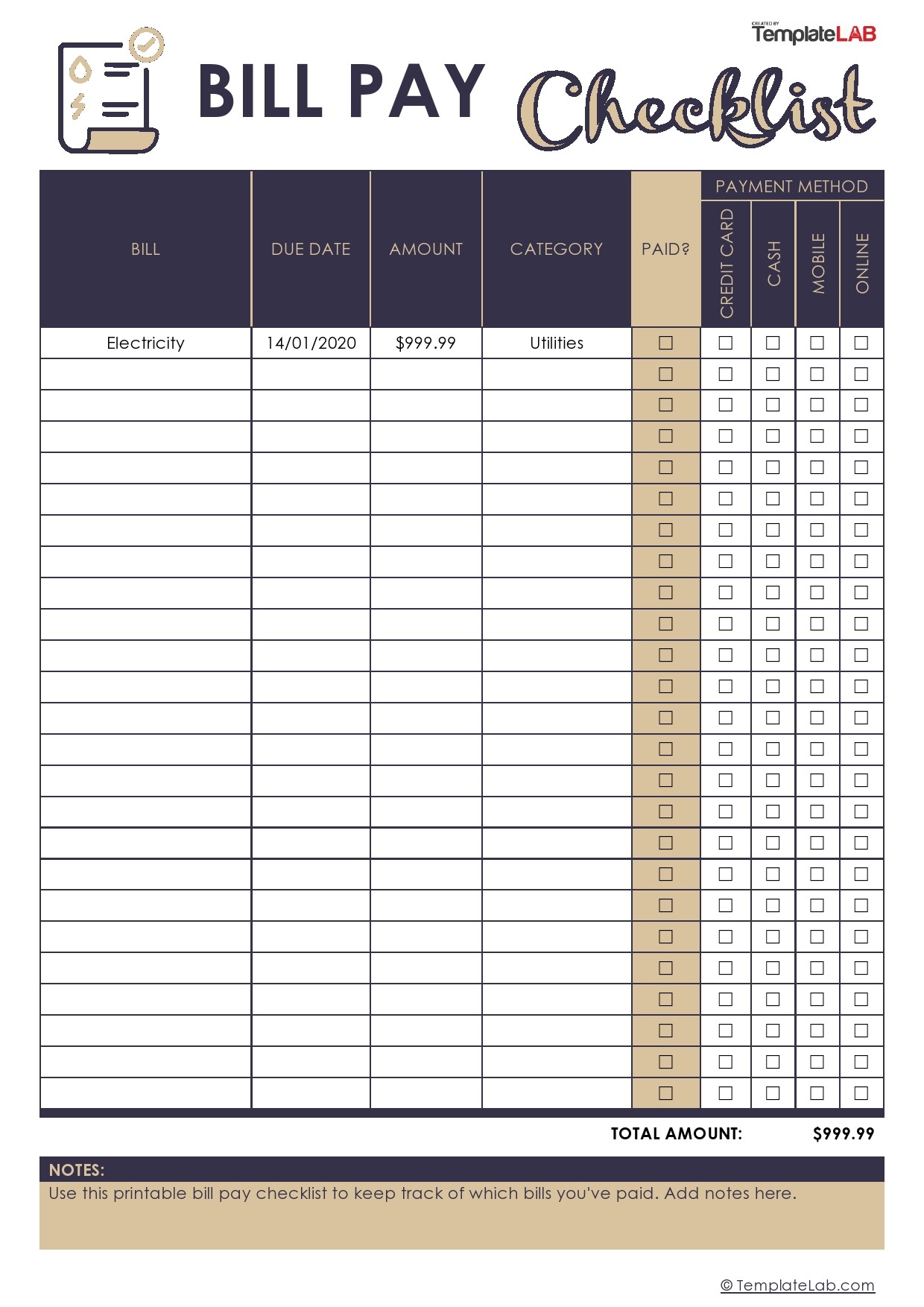

Monthly Bill Free Printable Bill Payment Checklist

/bill-pay-checklist-page-001-5823b7fc5f9b58d5b153dbb6.jpg?w=700)

Keeping track of your monthly bills can be a right faff, but it’s right important to make sure you’re paying them on time to avoid any aggro. This free printable bill payment checklist will help you stay organised and on top of your finances.

What’s Included in the Checklist?

The checklist includes the following sections:

- Bill due dates

- Amount due

- Payment method

- Notes

How to Use the Checklist

To use the checklist, simply download and print it out. Then, fill in the information for each of your monthly bills. You can then keep the checklist in a handy place, like on your fridge or desk, so you can easily refer to it when you need to.

Benefits of Using the Checklist

Using the checklist has a number of benefits, including:

- Helps you stay organised and on top of your finances

- Avoids late payments and fees

- Makes it easy to see how much you’re spending each month

- Helps you identify areas where you can save money

Get Your Free Checklist Today!

To get your free printable bill payment checklist, simply click on the link below. Then, start using it today to get your finances in order!

Download the Free Printable Bill Payment Checklist

Questions and Answers

Q: What are the key benefits of using a Monthly Bill Free Printable Bill Payment Checklist?

A: The checklist provides a centralized and organized system for tracking bill payments, ensuring timely payments and avoiding late fees. It promotes financial responsibility by fostering awareness of upcoming due dates and payment amounts.

Q: How do I customize the bill payment checklist to meet my individual needs?

A: The checklist is designed to be flexible and adaptable. You can add or remove categories based on your specific bills, adjust payment schedules to align with your income flow, and personalize it to suit your preferences.

Q: What strategies can I use to manage irregular bills that don’t have fixed due dates?

A: For irregular bills, estimate the average monthly expense and budget accordingly. Set up reminders or alerts to track these bills and make payments as needed. Consider using a separate envelope or digital tracking system to manage these expenses.